Chinese auto market in 2020 falls by 4.1% as the pandemic and lockdowns affect sales. Full-Year sales have been 24.7 Million. The leader Volkswagen reports the worst performance on the leaderboard by falling 16.2% and losing 1.5% share.

Market Trend

The Chinese car market has been hit slightly in 2020 despite the world-wide COVID-19 pandemic, which has impacted sales everywhere in the world.

The market has slowed down since 2016, after having achieved 30% of global sales. The future evolution is clearly driven more by real solutions regarding the two main issues created by the last decade’s market boom: pollution, and traffic congestion.

The Chinese government has shifted its attention from total volume to engine mix and is progressively creating incentives for small and low emission vehicles while supporting investment in the AFVs, mainly electric. In this direction, in January 2017 it has been increased the duties for vehicles with engine displacements over 1.6 liters (from 5% to 7.5%). During 2017, sales have been 28.2 million, up 0.9%.

However, in 2018, new light-vehicle sales have progressively lost steam, following the deceleration of the domestic consumer demand. Indeed, The market interrupted the positive trend of recent years losing for the first time since the ’90s and closing 2018 with 27.5 million units sold (-3.7%). In 2019 the Full-year ended at 25.7 million, down 6.5% from the previous year

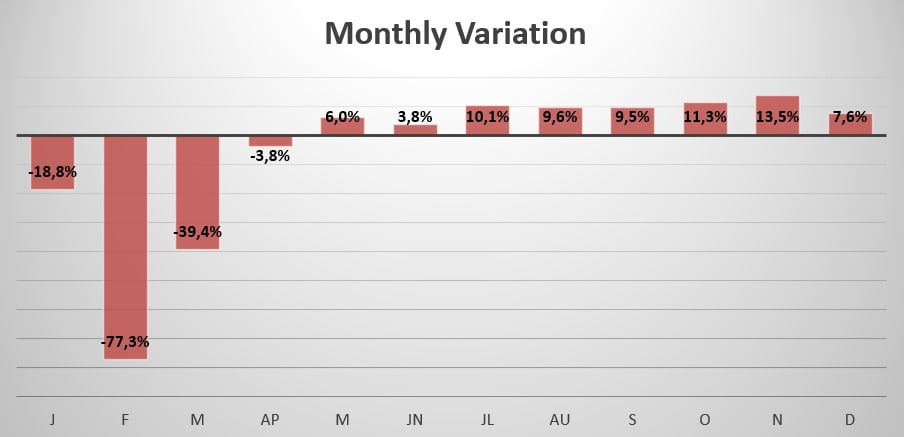

After starting the year negatively (-18.8%), the market quickly collapsed in February as the virus started spreading well before any other country. The sharpest drop in sales this year was in fact February when sales declined by 77.3% due to heavy restrictions. The market recovered quickly and started growing again in May (+6%).

The second half of the year has been entirely positive, in fact, every month reported positive sales, with July (+10.1%), October (+11.3%) and November (+13.5%) up in double-digits.

Indeed, Full-Year sales for 2020 have been 24.730.045, reporting a decline of 4.1% compared to 2019.

Brand-wise, this year the leader Volkswagen (-16.2%) lost 1.5% market share and registered the worst performance in the leaderboard, followed by Honda (+4.7%), which gained 0.6% share. Toyota gained 0.7% share, increasing sales by 7.7%. Nissan reached 4th place while losing 4.1%, followed by ChangAn -up 1 spot- which gained 4.4%.

Geely fell in 6th place by losing 6.8%, followed by Wuling (+7.9%) and Buick which gained 7% sales. Closing the leaderboard we have Mercedes -up 2 spots- reporting the best performance in the leaderboard by gaining 10% and Dongfeng -down 1 spot-, losing 7.4%.

The most sold vehicle this year has been the Nissan Sylphy (+15.2%) with 542.725 units sold and jumped 1 spot, followed by the Wuling Mini Truck, which gained 14.2% registering 477.569 new sales this year. The Volkswagen Lavida (-21.3%) closes the podium by falling 2 spots and reports 419.793 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models.