Italian Auto market in 2020 falls by 27.8% as the country was the first after China to be severely hit by the pandemic. Full-year sales have been 1.38 Million, the lowest annual volume since 2014. HEV, BEV, and PHEV surge as EU incentives boost sales.

Market trend

The Italian car market suffered tremendously in 2020 as the global pandemic has impacted Italy very quickly. In fact, the fall was so harsh that we recorded the lowest annual volume for the country since 2014.

Following the deep loss during the 2008-2011 crisis, when the market fell down from 2.4 up to 1.4 million units, the Italian vehicles market recovered in the period 2012-2017 reaching back the 1.96 million cars (plus LCVs to arrive at a total light vehicles market of 2.14 million).

Back at the physiological level, the market growth ended and a new phase, moderately declining, started in 2018 when sales declined 2.6% while holding a flat trend in 2019 with 1.92 million units sold.

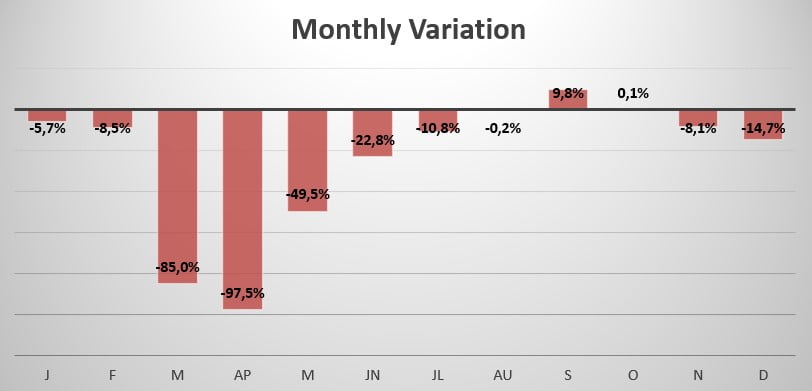

After starting the year with a slight negative trend (-5.7%), a new era started in March for the entire World, and the immediate effect of measures taken by the Italian government to counteract the spread of the virus has blocked any commercial activity in the country.

After China, Italy was the first large country hit by the virus and despite the immediate actions taken by the government, the country is paying a huge contribution to this war. In fact, sales in April fell 97.5% as the country was in full lockdown.

Thanks to EU government incentives and the loosening of restrictions the market recovered effectively in the subsequent months, even reporting a 9.8% growth in September. In the following months, sales fell again significantly as the country was hit by the second wave of infections, and new restrictions were introduced.

Indeed, Full-Year sales for 2020 have been 1.380.202, reporting a decline of 27.8% compared to 2019.

Looking at sales by fuel type, all the traditional ICE types fall faster than the market: petrol is off -38.7% to 523.140 and 37.5% share vs. 44.3% in 2019, diesel is down -40.2% to 461.274 and 33.1% share vs. 40% and GPL drops -31.1% to 94.260 and 6.8% share vs. 7.1%. In contrast, HEV soars 103% to 223.321 and 16% share vs. 5.7% in 2019, BEV surges 207.6% to 32.538 and 2.3% share vs. 0.5% last year and PHEV is up 319.1% to 27.408 and 2% share vs. 0.3%.

Brand-wise, this year the leader Fiat (-26.2%) gained 0.4% market share, followed by Volkswagen (-27.6%), which gained only 0.1% share. Ford as well gained 0.1% share, falling 27%. Renault lost 24.7%, followed by Peugeot which lost 25.9%.

Toyota registered the best performance in the leaderboard by losing only 21.3% and jumped 1 spot, followed by Citroen (-25.7%) jumping 1 spot as well and Jeep (up 2 spots) which lost 27% sales. Closing the leaderboard we have Opel -down 3 spots- registering the worst performance by losing 44.3% this year and Dacia falling 1 position by losing 36.5%.

The most sold vehicle this year has been the Fiat Panda (-45%) for the 9th year in a row with 80.121 units sold, followed by the Fiat 500x -up 2 spots-, which lost 25.3% registering 31.778 new sales this year. The Renault Clio (-24.3%) closes the podium by jumping 2 spots as well and reports 31.638 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models.