Spanish auto market in 2020 falls by 31.8% as the pandemic and lockdowns affect sales. Full-Year sales have been 858.022, the lowest annual volume since 2013. The Dacia Sandero ends 12-year streak of Seat domination as most sold car in Spain.

Market Trend

The Spanish car market has suffered tremendously in 2020 reflecting the heavy impact the pandemic had on the entire country. In fact, the fall was so harsh that we recorded the lowest annual volume for the country since 2013.

Spanish vehicles market was recovering year-after-year since the tremendous fall reported after the 2009 crisis when volume dropped by over half. The government has sustained the recovery of the industry, crucial for a market that is the second major auto producer in Europe, with an incentive plan called PIVE, which sustains a scrap of old vehicles when purchasing a new one, with low emission levels.

PIVE program has been modulated across the years becoming a stable sustain to the domestic market and in the last six years it grew up from less than 0.7 million cars in 2012 to almost 1.3 million units in 2019.

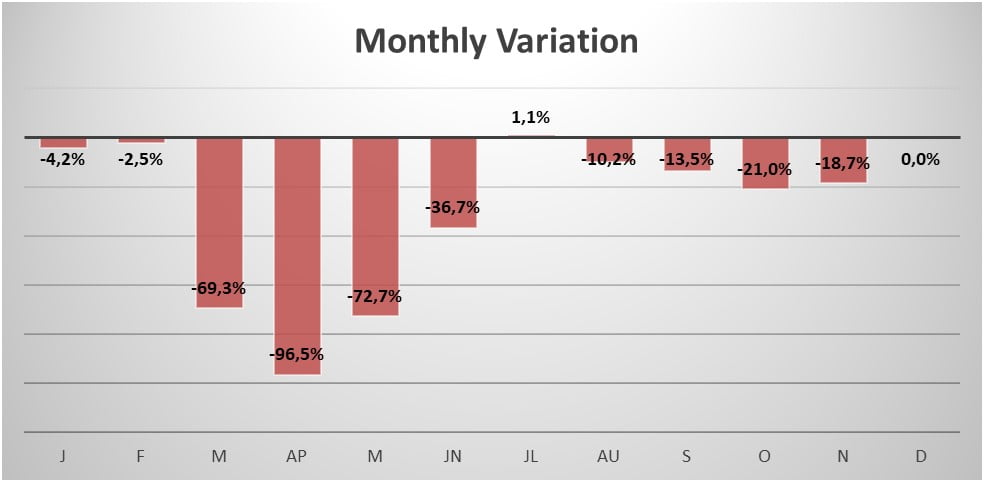

After starting the year with a slight negative trend, the market quickly collapsed in March as the virus struck. The sharpest drop in sales this year was in April when sales declined by 96.5% since the entire country was in a complete lockdown. The market recovered in the following months up until a very slight growth in July (+1.1%) but experienced another fall as the second wave of infections hit the country.

Indeed, Full-Year sales for 2020 have been 858.022, reporting a decline of 31.8% compared to 2019.

Brand-wise, the Spanish market is one of the less concentrated in the world, in fact, the top 10 brands control only 70.3% of the market, but this number has been rising quickly this year, since last year the control of the biggest manufacturers was 7.2% lower.

This year the leader Peugeot (-32.3%) lost 0.3% market share, followed by the growing Volkswagen (-25.3%), which gained 0.7% share by overtaking Renault, falling 28%. Seat remained in 4th place despite reporting the worst performance in the leaderboard (-38.5%), followed by Toyota -up 2 spots- which on the other hand reported the best performance, losing “only” 19.2%.

Ford fell from 5th to 6th position this year, losing 34.2% sales, followed by Dacia (-24.5%)-up 1 spot- and Kia which jumped 4 spots and lost 20% sales. Closing the leaderboard we have Hyundai -up one spot- losing 27.6% this year and Fiat falling in last place by losing 29.3%.

The most sold vehicle this year has been the Dacia Sandero (-29.1%) with 24.035 units sold, ending the 12-year streak of Seat domination in the market by overtaking the Seat Leon, which lost 34.2% registering only 23.585 new sales this year. The Nissan Qashqai (-34.3%) closes the podium and remains in 3rd position with 19.818 units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models.