Mexico’s vehicle market in 2021 rises by 6.4% with 1 million sales, reporting a positive performance in Q2 and Q3, but started falling again in Q4. Chevrolet reports the worst performance, falling 16.4%.

Market Trend

The Mexican car market this year recovered slowly, and reported positive performances in Q2 and Q3, but started falling again in Q4.

The Mexican automotive industry grew up uninterruptedly for the entire period 2010-2016 with light vehicles sales booming from 803,222 (2010) to the all-time record of 1,604,000 (2016) and the growth of the domestic market was simultaneous to the huge development of the local production, which boomed for new localization done by new manufacturers like Honda, Mazda, Hyundai, Kia and by the expansion of already existing companies, like Ford and General Motors.

In 2016 Mr. Trump became President of the United States. The Mexican domestic market was at a high peak and it was expected a steady decline before starting a new positive path and indeed in 2017 sales declined just 5% at 1.53 million.

However, the start of the revision of the commercial agreement with the US and the increase of tariffs blocked the growth of the Mexican economy and the major industrial sector, the automotive was even more penalized by new limits to the export to the US zone. The negative trend became more “structural” than expected and sales declined in 2018 and 2019.

Due to the COVID-19 pandemic sales fell in 2020. In fact, 949,121 units have been sold, reporting a decline of 28% compared to 2019.

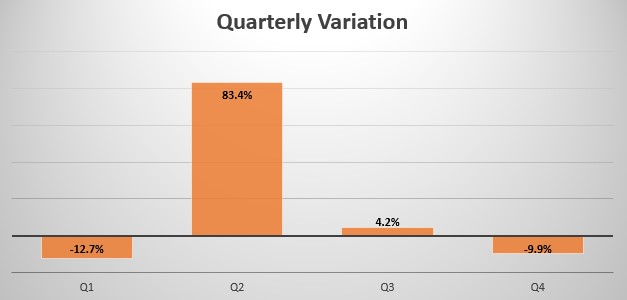

In 2021 the year started negatively for the Mexican market, in fact, in Q1 259,034 units have been sold, reporting a 12.7% decrease in sales compared to Q1 2020, while in Q2 sales started growing quickly, reporting a 83.4% increase in sales with 256,361 units due to the low volumes in Q2 2020.

In Q3 sales kept growing but slowed down, gaining just 4.2% with 237,322 units, followed by a 9.9% loss in Q4 with 256,834.

Indeed, Full-Year sales for 2021 have been 1 million, reporting a 6.4% increase compared to 2020.

Brand-wise, this year the leader Nissan (+4.9%) lost 0.4% market share, followed by Chevrolet (-16.4%), which lost 3.3% share and reported the worst performance on the leaderboard. Volkswagen on the other hand lost 0.8% share, falling 1.3%. Toyota remained in 4th place and reported a 19% gain, followed by Kia which gained 11.4%.

Mazda -up 1 spot- gained 1.7%, overtaking Honda (-10.8%) while Ford gained 9.7%. Closing the leaderboard we have Hyundai gaining 15.4% this year and Suzuki reporting the best performance by gaining 27.2%.

The most sold vehicle this year remains the Nissan Versa (+2.6%) with 69,775 units sold, followed by the Nissan NP300, which gained 8.8% registering 48,495 new sales this year. The Chevrolet Aveo (+19%) closes the podium and reports 37,039 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 models.